BTC Price Prediction: Navigating Between Technical Resistance and Fundamental Strength

#BTC

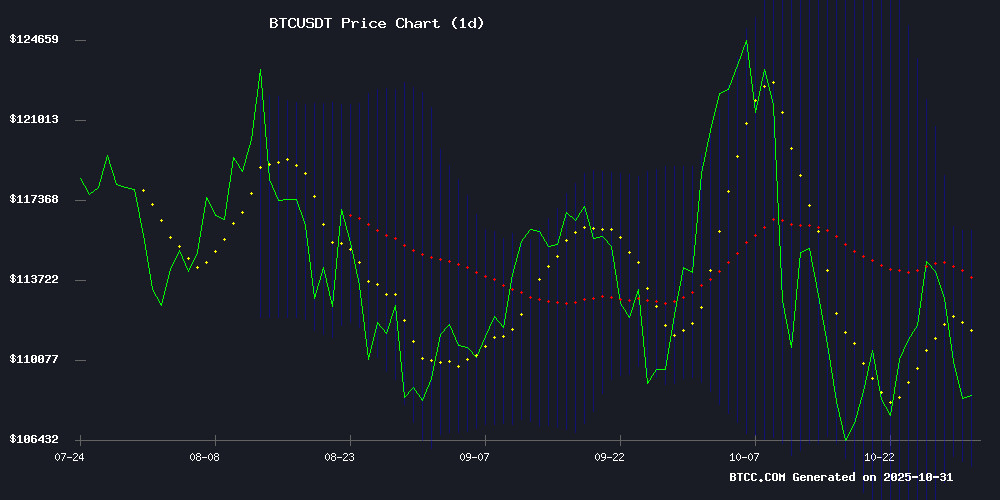

- Bitcoin trades below key moving average but within Bollinger Band consolidation range

- Mixed market sentiment with regulatory concerns balanced by strong institutional fundamentals

- Price direction hinges on breaking either the $110,650 resistance or $105,355 support level

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Moving Average

According to BTCC financial analyst William, Bitcoin currently trades at $109,606.65, slightly below the 20-day moving average of $110,650.64. The MACD indicator shows bearish momentum with a negative histogram reading of -2,095.20, suggesting short-term pressure. However, William notes that Bitcoin remains within the Bollinger Band range between $105,355.80 and $115,945.49, indicating the asset is in a consolidation phase rather than a strong downtrend.

Market Sentiment: Regulatory Concerns Offset by Institutional Strength

BTCC financial analyst William observes mixed market sentiment from recent developments. Negative factors include potential bitcoin mining restrictions in Russia and regulatory reassessments by global banking authorities. However, William highlights positive fundamentals including Tether's record $10B+ profits and excess reserves, alongside Bitcoin holders demonstrating resilience during volatility. The analyst suggests these institutional strengths provide underlying support despite short-term regulatory headwinds.

Factors Influencing BTC's Price

MicroStrategy's Bitcoin Premium Shrinks Amid Slower Q4 Momentum

MicroStrategy reported a $2.8 billion net income beat in Q3, but its premium over Bitcoin holdings collapsed to 1.3×—down from over 2× during peak enthusiasm for its BTC treasury strategy. The company’s market-adjusted net asset value now barely outpaces its Bitcoin stash, signaling fading investor confidence in its capital-raising prospects.

Analysts from Cantor Fitzgerald, TD Cowen, and Maxim Group slashed price targets post-earnings, pushing the stock’s average target to a May low. Concerns center on decelerating Bitcoin price gains, thinner premiums, and weaker capital issuance. "4Q is off to a slow start," warned TD Cowen’s Lance Vitanza, noting stalled BTC appreciation and reversed premiums.

While MicroStrategy booked $3.9 billion in unrealized bitcoin gains, the pace has cooled. The firm’s fate remains lashed to BTC’s volatility—a gamble that once thrilled markets but now draws skepticism as execution risks mount.

Global Banking Regulators Reassess Crypto Rules Amid Stablecoin Concerns

Global banking regulators are moving to revise capital requirements for crypto assets, particularly stablecoins, as the original Basel standards face pushback from major economies and industry players. The 2022 framework imposed a 1,250% risk weight on unbacked cryptocurrencies like Bitcoin, effectively sidelining banks from crypto markets.

The Basel Committee on Banking Supervision is now reconsidering these rules, acknowledging the rapid evolution of stablecoins and shifting regulatory attitudes. The review could mark a pivotal moment for institutional crypto adoption, as current standards force banks to hold capital equal to their entire crypto exposure.

Market participants have long criticized the Basel rules as overly conservative, arguing they stifle innovation in digital asset markets. The proposed amendments may create a more nuanced approach to crypto risk assessment, particularly for asset-backed stablecoins gaining traction in global payments.

Singapore Freezes $150M in Assets Linked to Alleged Bitcoin Fraud Kingpin

Singapore authorities have seized over S$150 million ($106 million) in assets tied to Chen Zhi, the Chinese-born chairman of Cambodia's Prince Holding Group. The enforcement action, carried out on October 30, targeted six properties, bank accounts, securities, cash, a yacht, 11 vehicles, and luxury alcohol bottles owned by Chen and his associates—none of whom were present in Singapore at the time.

The crackdown follows a global investigation led by U.S. and UK prosecutors, who indicted Chen in mid-October for allegedly masterminding a transnational fraud operation worth $14.4 billion. Prince Holding Group, founded in 2015 under the guise of real estate and hospitality ventures, is accused of evolving into a criminal network that trafficked workers to Cambodia for forced participation in crypto scams.

Court documents reveal victims were lured to fake cryptocurrency trading platforms after prolonged grooming. The syndicate reportedly laundered proceeds through a complex web of digital assets—though none of the flagged coins or exchanges appear directly implicated in Singapore's seizure.

Bitcoin Under Pressure Toward $90,000: The End of the Bull Cycle? | November Report

Bitcoin closed October with a sharp correction but avoided structural damage, consolidating between $105,000 and $116,000. The balance between buyers and sellers suggests a market reset rather than a cycle end. Institutional inflows into Bitcoin ETFs stabilized after October’s outflows, signaling cautious confidence.

Liquidity and sentiment remain pivotal for a potential year-end rebound. With a yearly performance of +53%, Bitcoin’s resilience echoes its 'digital gold' status. Spot gold’s 35% rise in 2024 underscores global instability, contrasting with Bitcoin’s five-year streak of >50% gains—except for 2022’s 62% drop.

A deeper pullback to $90,000 remains possible if $100,000 support falters, but institutional interest and historical resilience leave room for optimism.

Bitcoin Treasury Companies: Visionary Strategy or Risky Gamble?

Bitcoin continues to polarize Wall Street as publicly traded companies aggressively accumulate the cryptocurrency. MicroStrategy, rebranded as Strategy, pioneered this approach in 2020, funding its BTC purchases largely through debt. The firm now holds over 640,000 BTC—more than 3% of Bitcoin's total supply—with an average purchase price of $74,802 per coin. Despite a 700% rally in Bitcoin's price over five years, Strategy's diminishing margins raise concerns about its resilience in a bear market.

The company's unwavering commitment to buying Bitcoin NEAR all-time highs has drawn both admiration and skepticism. While its unrealized profits total billions, the strategy hinges on Bitcoin's continued appreciation. Traditional financiers remain divided, with some viewing corporate Bitcoin treasuries as a bold innovation and others as a precarious gamble.

Bitcoin Holders Show Resilience Amid Market Volatility

Bitcoin's price dipped below $110,000 in a sudden Thursday pullback, reflecting broader bearish sentiment across cryptocurrency markets. Despite the downturn, on-chain data reveals investors are holding firm rather than capitulating—a sign of underlying confidence.

Exchange withdrawal metrics remain stable, with no significant uptick in BTC movements since October 2024. Joao Wedson of Alphractal notes this marks the first cycle with such subdued on-chain engagement, suggesting investors increasingly prefer exchange-based custody during volatility.

Russia Considers Year-Round Bitcoin Mining Ban in Siberian Regions

Moscow is weighing a permanent prohibition on cryptocurrency mining in Buryatia and Zabaykalsky Krai, moving beyond seasonal restrictions currently imposed during high-energy-demand winter months. The Siberian territories—already grappling with electricity shortages—could join Irkutsk Oblast where mining is banned until 2031.

"We're monitoring the situation. If necessary, we'll respond promptly," stated Olga Arutyunova of Russia's Energy Ministry during a Federation Council meeting. The potential crackdown highlights growing tension between Bitcoin's energy-intensive proof-of-work mechanism and regional power infrastructure limitations.

Tether Reports Record $10B+ YTD Profit and $6.8B Excess Reserves in Q3 2025

Tether's Q3 2025 attestation reveals staggering financial performance, with year-to-date profits surpassing $10 billion and excess reserves reaching $6.8 billion. The stablecoin issuer now holds $181.22 billion in reserves against $174.45 billion in liabilities, demonstrating robust backing for its USDT tokens.

USDT circulation surged by over $17 billion during the quarter, exceeding $174 billion by September and climbing further to $183 billion in October. The reserve composition shows $135 billion in U.S. Treasuries—a position that would rank Tether among the top 20 sovereign holders globally—alongside $12.9 billion in gold and $9.9 billion in Bitcoin.

The company maintains a strict separation between its stablecoin reserves and proprietary investments in emerging sectors like AI and renewable energy. With claimed user adoption surpassing 500 million accounts, Tether continues to cement its dominance in the digital dollar ecosystem despite macroeconomic headwinds.

$870 Million Wiped From The Crypto Market: Bear Market Here?

Nearly $870 million was liquidated from the cryptocurrency market in the last 24 hours, according to CoinGlass data. The sell-off dragged Bitcoin below $109,000 and erased $3.77 trillion from global crypto market capitalization. This downturn defied expectations of a rally following the Federal Reserve's rate cut announcement, with Chair Jerome Powell's warnings about slowing growth and persistent inflation appearing to trigger risk-off sentiment.

Historical October bullish patterns failed to materialize in 2025, marking the sector's second major liquidation event this month. CoinCodex analysts project a potential 13.9% Bitcoin rebound to $124,680 by early November before another pullback. Market participants now debate whether this constitutes a temporary correction or the start of a sustained bear market.

The Hidden Cost of the Charts: How Crypto Trading Impacts Mental Health

Crypto markets are infamous for their unpredictability. Bitcoin (BTC) can surge by 20% overnight, only to lose the same amount by the morning. Traders, tethered to price charts and social media feeds, often find themselves caught in an endless cycle of hope, fear, and regret.

Recent studies reveal crypto trading's significant toll on mental health. A National Library of Medicine (NLM) review likens it to gambling's high-risk, high-reward nature, citing psychological challenges including anxiety, depression, and addictive behaviors. The study of 11,177 participants across multiple countries found traders exhibit higher stress levels, COVID-19 anxiety, and perceived loneliness compared to non-investors.

Extreme losses have led to tragic outcomes, with the largest market crash liquidating $19.36 billion in 24 hours. The psychological distress among traders underscores the volatile market's human cost.

From $1K Bitcoin Bet to $88M Fortune: Jackson Zeng's Crypto Journey

Jackson Zeng's $1,000 Bitcoin investment in 2013—initially dismissed by his parents as reckless—catapulted the struggling student into an $88 million crypto fortune. The Caleb and Brown CEO held through volatility, proving early conviction pays off. Bitcoin’s 2025 price projection of $190,000 and Swyftx’s $200 million acquisition now underscore his prescience.

Zeng co-founded Australian exchange Swyftx in 2017 after his BTC holdings appreciated exponentially. "My parents thought I was throwing money away," he recalls. The narrative exemplifies how counterintuitive bets can redefine wealth-building in digital asset markets.

How High Will BTC Price Go?

Based on current technical and fundamental analysis, BTCC financial analyst William provides this assessment:

| Indicator | Current Level | Implication |

|---|---|---|

| Price vs 20-day MA | $109,606.65 vs $110,650.64 | Slight bearish pressure |

| MACD Histogram | -2,095.20 | Short-term momentum negative |

| Bollinger Band Position | Middle to Lower Range | Consolidation phase |

| Key Resistance | $115,945.49 | Upper Bollinger Band |

| Key Support | $105,355.80 | Lower Bollinger Band |

William suggests that breaking above the 20-day moving average at $110,650 could target the upper Bollinger Band near $116,000, while failure to hold current levels might test support around $105,350. The fundamental strength from institutional adoption provides longer-term bullish potential despite near-term technical challenges.